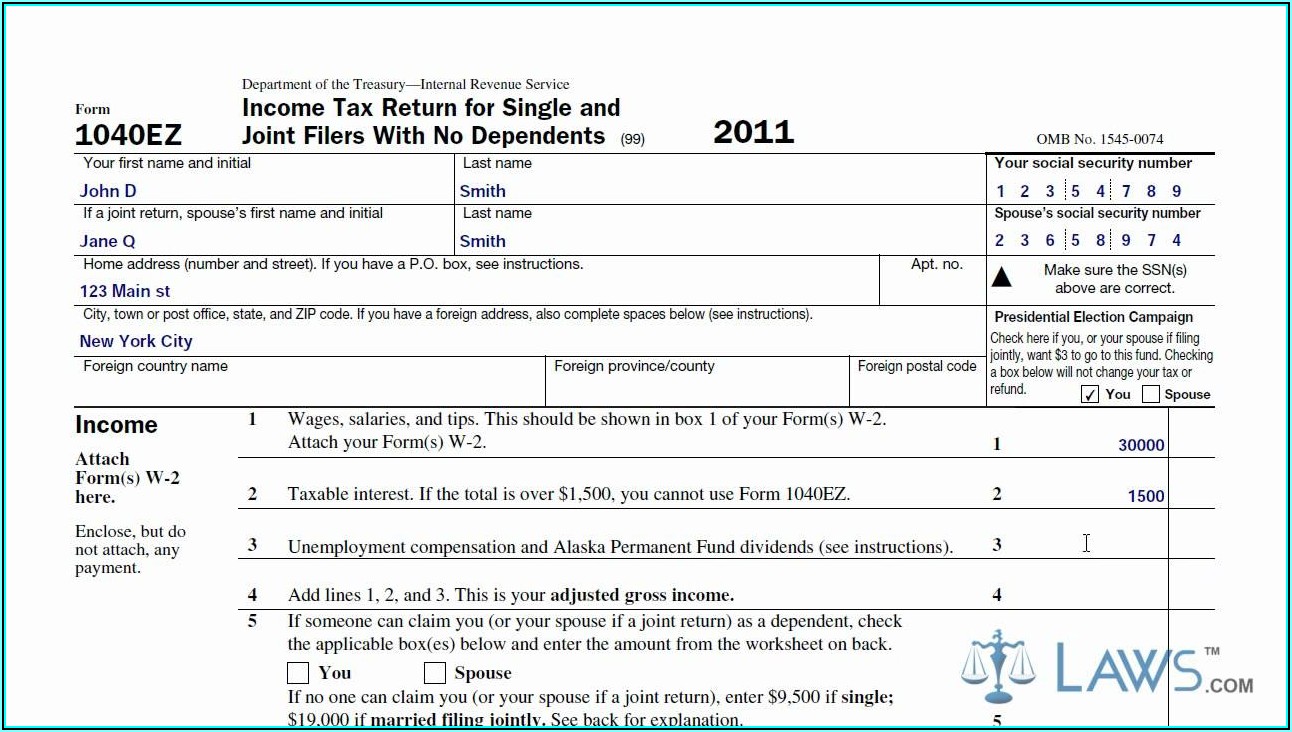

Checking a box below will not change your tax refund. (chuckles) So let's see what else here, foreign country name, well we're just assuming that he's based, that I'm, I'm Joe Singleguy, I'm based in the US so I wouldn't fill out any of this and then check here if you or your spouse filing jointly want $3 to go to this fund for presidential elections. My social security number, 12, I hope I don't experience any identity theft by giving this away, and let's see, I'm assuming he's single so there's no spouse name over for this line and then the address, so 123 Main Street and I live in Big City, let me write a little bit neater, the IRS needs to be able to read this, Big Big City, California, and my zip code is 12345, which I don't think is an actual zip code in California but I think you get the picture, I'm trying to prevent identity theft here. But let's say my name, my first name, let's say it's Joe and my last name, I'm Joe Singleguy, Joe Singleguy, I guess it'll be a strange name once I get married but I'll just go with it. So up here, there's just your basic information, so let's see, and I'm just gonna assume that I'm filling this out as a single individual but you could also fill it out as married. And this isn't going to be for everyone, it tends to not be for people with parents or people with an income over 100,000 or homeowners or people who have I guess more complex either income or they have a lot of deductions that they might wanna itemize but it tends to be a pretty good tax form for folks who are filing their taxes for the first time, might only have one job and have a fairly simple financial picture so let's just go through this and then obviously it might get more complex or it will get more complex as you decide that you can't use this form, that you have to use a more fancy form.

And I'm going to start with, or at least in this video, I'm going to use the most simple of the IRS forms, 1040EZ, literally, I guess because it's supposed to be easy.

So what I wanna do in this video is really show you an example of filling out your taxes and hopefully giving you a little bit of context for why the form looks like it does or where you might find the relevant information. Filling out your taxes can be intimidating for anyone and especially if you've never done it before.

0 kommentar(er)

0 kommentar(er)